Welcome to “Fridays with Scott” segment of the Climate Change program.

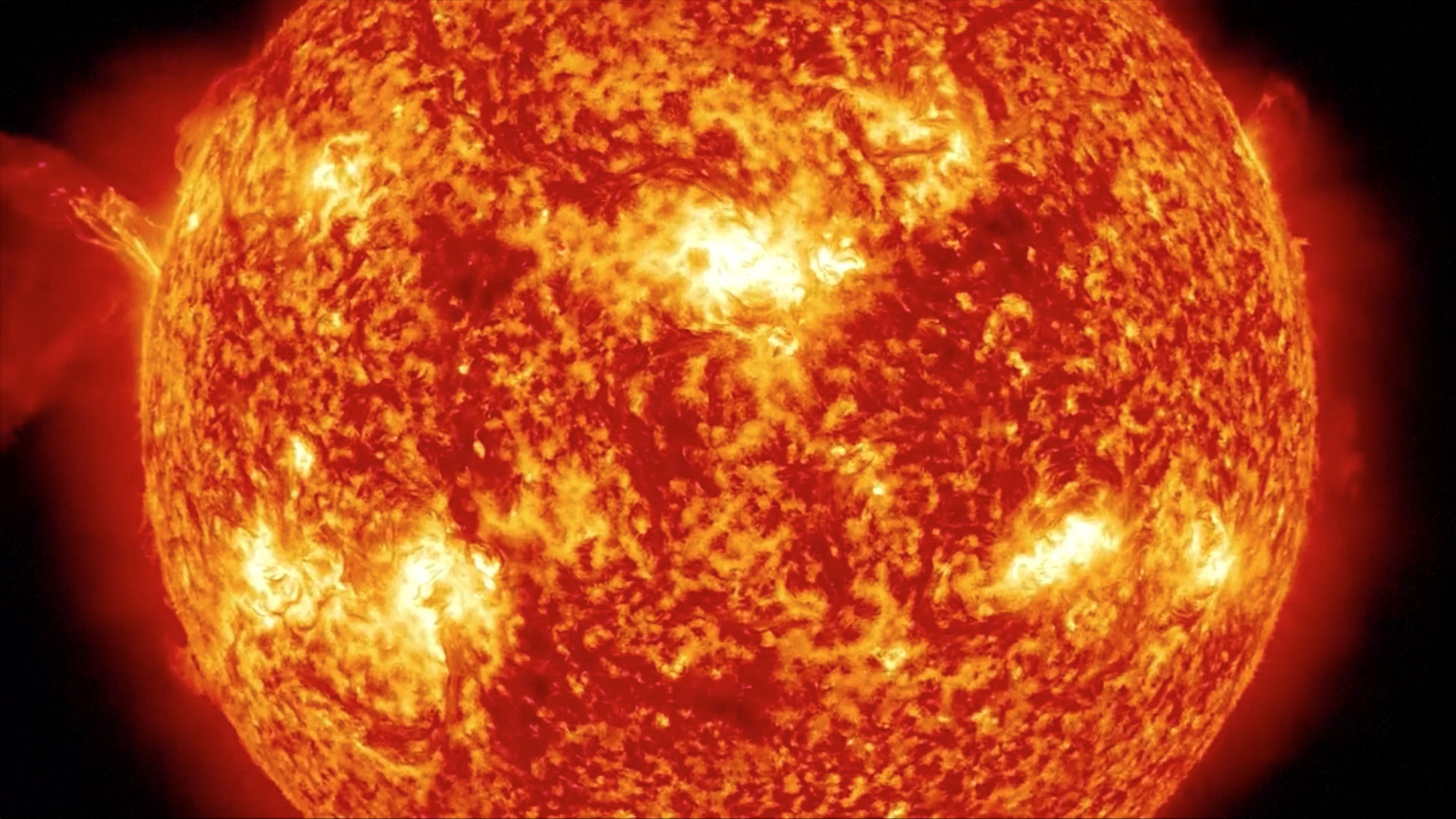

Today is Solar Appreciation Day, which was created to build awareness of the benefits of solar energy and its ability to help create sustainable energy. Solar energy continues to be one of the most popular and cost-effective sources of clean energy.

In this multi-series, I explore the investment appetite for clean energy.

To gauge investor confidence on the impacts of market and policy changes, the American Council on Renewable Energy (ACORE) polled senior-level respondents across the nation’s leading banking institutions, asset managers, private equity firms, and other financial firms.

The survey, “The Future of U.S. Renewable Energy Investment: A Survey of Leading Financial Institutions,” reveals a robust market with significant potential to accelerate the renewable sector’s growth. Two-thirds of respondents plan to increase investments more than 5 percent in 2018 compared to 2017, and half plan to increase investments more than 10 percent.

While America’s aging grid infrastructure and mixed policy signals could limit future expansion, the financial sector expects renewable energy will continue to be an attractive asset class and anticipates investor confidence will remain high. Respondents projected that their companies will at a minimum double their expected business-as usual investments in U.S. renewables between 2018 and 2030.

Ultimately it’s policy signals and market factors that will drive investment. Renewable energy investors seek long-term policy certainty. The solar and wind industries already know existing tax credits remain on schedule to phase out after 2021, and federal policy signals is important to long-term investor confidence, which under the White House administration is at an all time low.

Investors say federal action to address climate externalities through carbon pricing and/or a technology-neutral tax credit for zero-carbon electricity generation could encourage growth. Also, state action is likely to play a significant role in stimulating demand through ambitious renewable portfolio standards along with siting and permitting process reforms.

Market factors like increased corporate purchasing, growth in energy storage and accelerating electric vehicle (EV) sales are expected to create new renewable energy opportunities – but investors say market-based signals reflecting the values and services provided by energy storage are needed to prevent America’s aging grid from hindering investment.

The American Renewable Investment Goal aims to reach $1 trillion in U.S. private sector investment for renewable energy and enabling grid technologies by 2030. This coordinated effort to accelerate the investment and deployment of renewable power as the sector moves to the next stage of market maturity charts a course for America’s investment community to modernize energy infrastructure and create massive economic opportunities.

Stay tuned next time to find out what other areas investors are looking to invest in climate change mitigation and response.